Are you interested to apply for a savings account and enjoy some benefits and bonus deals? JP Morgan Chase Bank is offering savings account services in more than 5,000 branches across the States. Find out everything you need to know about Chase savings account options, benefits and fees in our post. We are here to provide you with useful information on how to open a Chase savings account that best suits your needs, as well as on how to register and manage your account online to make payments and start saving.

What is the Chase Savings Account?

Chase Bank has created Chase savings account programs to respond to your financial needs in a more enhanced way, as well as to provide you with more benefits and rewards. The Chase savings account deals range from bonus points on purchases, no annual fee, 24/7 online banking and Chase bonus coupons when opening a new account.

How to Apply for a Chase Savings Account?

First, there are several types of Chase savings accounts to choose from. You can either apply for a saving account with basic saving features or for a saving account with higher interest rates for higher balances. Here are the benefits, fees and features for each account option:

Chase Savings Account Benefits:

- 24/7 online banking.

- Mobile banking.

- Security guaranteed.

- Access to over 18,000 Chase ATMs and 5,500 branches in the US.

- A $5 monthly service fee if the owner is younger than 18 or if you wish to link your saving account to your Chase checking account for Overdraft Protection.

- A minimum daily balance of $300.

The second option you have is the Chase Plus Savings Program. Here are the extra advantages you get as compared to the basic Chase savings account.

- Higher balances and interest rates.

- A $15,000 or more daily balance in this account for a $20 monthly service fee.

- Account alerts so that you are always in control of your finances and changes that occur.

Note: Check the Account Disclosures and Rates for more information on miscellaneous fees that apply.

In order to open a Chase savings account, click on OPEN NOW on their savings account page.

Here is what you will need:

- Have internet connection and dedicate a few minutes of your time.

- Have a printer as you will need to print the required documents.

- Provide information such as: name, phone number, email address, Social Security Number, and driver’s license or state-issued ID.

- Make an opening deposit by using funds from a debit or check card, from a Chase checking account or other savings account, or from an account you have registered with another bank.

- You can save your application in progress and complete it later if you need more assistance.

How to Register a Chase Savings Account Online

In order to have access to your Chase savings account online, you need a few minutes to enroll and comply with the following requirements:

- Have your Social Security Number or Tax ID Number handy.

- Have your Chase account, credit or debit card numbers handy.

- Use a phone number or email address you have already provided in the past.

Here are the steps to follow for a successful online registration:

- Visit the Chase account online enrollment page.

- Choose either ‘Personal’ or ‘Business or both’ depending on the type of your Chase saving account.

- Enter identification information in the indicated fields, such as Chase bank account number and Social Security Number.

- Choose your User ID.

- Finish registering by following the next indications provided on the page.

How to Make a Chase Credit Card Payment

You can make a Chase Credit Card payment online by logging on to your account.

Also, there are other payment methods enabled by Chase Bank through:

- Automated phone service.

- Customer Service assistance by phone.

- One of the Chase branches.

Make sure you mail your check or money order, along with your contact and account information (chase bank account number) to:

Card Member Services

P.O. Box 94014

Palatine, IL

60094-4014

- Western Union – if you make payments through Western Union, use the Code City Walnut. Take note that it may take up to 7 business days before the payment is posted on your account.

Generally, your payments are credited and posted on the same day, or the next day for all payment options except Western Union. This depends on the time you make the inquiry.

What Other Rewards and Benefits are There for You?

Chase Banks also offers you a series of Rewards Credit Cards. Let us briefly present the best credit card deals they have for you.

Chase Freedom Card

Here are the rewards you can get if you choose a Chase Freedom Card:

- No annual fee.

- 0% cost of credit for 15 months.

- $200 bonus for $500 spent on purchases in the first 3 months after opening your account.

- Unlimited 1% cash back on all other purchases.

- $25 Bonus for your first authorized user and purchase.

If you wish to upgrade your Chase credit card account, you can choose the Chase Sapphire Preferred Card and benefit from:

- Bonus Points

You can earn 5,000 bonus points after you create the first authorized user and purchase something within three month from opening the account.

- Earn Point on Travel and Dining at restaurants

- Transfer points to participating frequent travel programs. This means that 1,000 reward points equal 1,000 partner points/ miles. This program includes but is not limited to British Airways Executive Club, Korean Air SKYPASS, and Southwest Airlines Rapid Rewards.

- No foreign transaction fees for purchases made outside the US.

- Embedded chip for an enhanced security and wider acceptance.

- 20% off travel when you pay for airfare, hotel, car rentals or cruises. According to Chase Ultimate rewards, a $500 flight requires 40,000 points which means that you save $100.

Chase Bonus Coupons

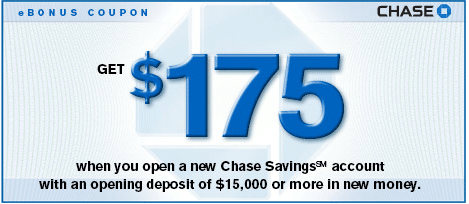

Another type of reward you can get are Chase bonus coupons when opening a new Chase savings account. The bonus value may depend on the deposit you make. Also, the bonus coupon come with a coupon code you have to use to redeem it.

Useful Information & Links

For more information about Chase savings account benefits and rewards credit cards we recommend you visit their official website.

If you have any other questions or inquiries, you can contact Chase Customer Service. They can answer to a variety of questions about credit cards, personal banking, loans and a lot more.

Chase Customer Service Phone Number: 1-800-432-3117.

Online or Mobile Banking Support: 1-877-242-7372 (US only); 1-713-262-3300 (Outside the U.S.).

You can also send secure email to Chase Customer Service by logging in to your Chase Credit Card account. One of their Customer Service representatives will answer to you within 4 hours.

This concludes our information on how to apply for a Chase Savings Account and profit from their benefits and deals. If you have further questions on the registration process, please leave a message in the comment box below. We encourage our readers to reach out to us with any questions, ideas, suggestions and thoughts.